| University | Singapore University of Social Science (SUSS) |

| Subject | FIN306: Financial Markets |

FIN306: Financial Markets Assignment, SUSS, Singapore Financial markets in 2022 are concerned with the return of inflation and the interest rate policy followed by central banks

Question 1

Financial markets in 2022 are concerned with the return of inflation and the interest rate policy followed by central banks.

(a) Illustrate the use of open market operations and interest rate fixing to control inflation.

(b) Explain the reserve requirements mechanism and its impact on the economy. Compare the current reserve requirement levels set by the Fed, ECB, and MAS.

(c) Compare the interest rate policy of leading central banks now and twenty years ago.

(d) Debate one (1) pro and one (1) con of quantitative easing on the financial markets.

(e) Examine the announcement policy by picking up the example of the Fed

Question 2

Lending is described as the bread and butter activity of the banking business.

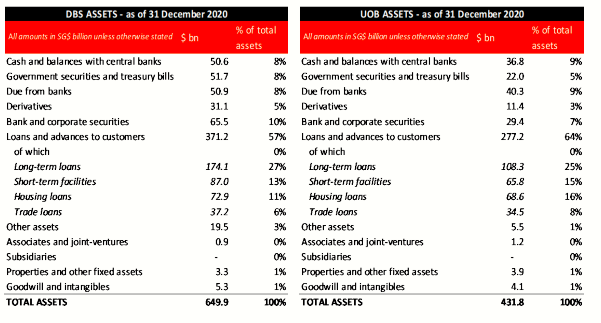

Below is the respective balance sheet reported by two well-known Singaporean banks, as found in their financial statements, disclosed in 2021.

(a) Compare the size and composition of the loan books of DBS and UOB.

Common types of loans include mortgages, credit cards, and trade loans.

(b) Describe those three (3) types of loans and their characteristics in terms of size, maturity, and risk-pricing by filling the table provided below.

Question 3

The second-largest kind of intermediaries in the financial systems after banks are funds, sometimes referred to as investment companies or the asset management industry.

(a) Distinguish and describe briefly five (5) types of funds.

Consider five different types of investors:

1. An accredited investor looking to beat the market returns without prescribed constraints.

2. A pension fund planning to hedge its long-term liabilities with safe fixed-income assets.

3. A corporate placing its excess cash for 2 months at better rates than a bank account.

4. A young investor with long-term return objectives and comfortable taking some risks.

5. A fund looking to diversify from traditional assets and get exposure to tech startups.

(b) Discuss an adequate mutual fund investment style for each of the above investors.

Assume a defined benefit plan pension fund with a perfectly balanced position between its invested assets and the present value of its future pension obligations. Over the next several years, the fund could face several possible scenarios:

1. The life expectancy of future pensioners gets longer than previously expected.

2. The discount rate used to compute the present value of future obligations is set to rise.

3. The stock portfolio the fund is invested in will appreciate beyond the prior forecast.

4. Some of the benefits offered to pensioners are going to be cut.

5. The inflation rate of medical care offered to future pensioners gets higher than before.

(c) Analyse under each of the above scenarios whether the fund position will stay balanced, run into a deficit, or become positive, all other things staying equal.

(d) Illustrate the reasons for an investor to buy into an ETF.

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

Discover unmatched academic support in Singapore with our specialized offerings: GBA expertise, personalized Individual Assignments assistance, reliable Online Exam Help, and convenient Assignment Help Online. We cater to the academic needs of students, including those at the esteemed Singapore University of Social Science (SUSS). Tackling FIN306: Financial Markets? Our experts are ready to guide you. Whether it's navigating the complexities of financial markets in 2022, understanding inflation's return, or central banks' interest rate policies, our services are designed for your success. Don't let academic challenges hold you back – invest in your journey by harnessing our expertise. Pay our experts and unlock the doors to academic brilliance today

- Imagine that you are currently working for a precision medicine startup: Machine Learning Paper Review in Precision Medicine, Written Assignment 1, NUS, Singapore

- Go Business offers PSG solutions for enterprises in Singapore: Collective Intelligence and Entrepreneurship, Assignment 1, JCU, Singapore

- Design an ontology based on- Accidents can be categorised as chemical, electrical, fire, kinetic or liquid: Collective Intelligence and Entrepreneurship, Assignment 1, JCU, Singapore

- Project Control Monitoring, Assignment, HU, Singapore: Deliberate Project MONITORING AND CONTROL or PMC Identification

- DSM500: Final Project Report, Coursework 2, UOL, Singapore

- DSM080: Financial Markets, Assignment, UOL, Singapore: A grapefruit juice futures contract is for 15,000 pounds of frozen grapefruit juice

- DSM080: Financial Markets, Assignment, UOL, Singapore: The share price of a certain stock today is $42.50, and five-month European style call options with a strike price of $45 currently sell for $4.25.

- DSM080: Financial Markets, Assignment, UOL, Singapore: A trader who is working in the gold markets is able to borrow money at the interest rate of 7% per annum

- DSM080 Financial Markets, Assignment, UOL, Singapore: A dollar-based American corporation has decided that it will have to pay 6 million UK pounds in three months

- Principle of Finance Assignment, UCD, Singapore: National Gaming Inc. (National) operates the weekly lottery in the country

UP TO 15 % DISCOUNT