B2090C Western Pte Ltd (“Western”) manufactures ready-to-eat meals: Management Accounting Assignment, SUSS, Singapore

Question 3

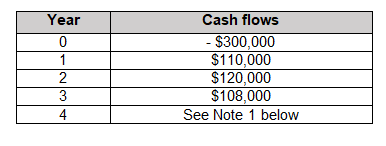

Western Pte Ltd (“Western”) manufactures ready-to-eat meals. Western is evaluating whether to invest in a new packaging machine.

The table below shows the relevant cash flows from the investment

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

- SC1007 Data Structures & Algorithms Assignment Question 2026 | NTU

- SOC309 Contemporary Social Theory Assignment Question 2026 | SUSS

- MKTG2060 International Marketing Assessment 1 Guidelines 2026 | UON

- GPS2301 Interventions & Strategies in Special Needs Education Assignment 2026 | TP

- PSB7022CL Marketing in a Global Age Assignment 2, 2026 | Coventry University

- PSB5045EE Analog and Digital Electronics (ADE) Assignment Questions 2026

- LG71011 Cold Chain Logistics Assessment Project 2026 | ITE College

- BUSM2578 Integrated Perspective on Business Problems Assignment 1 2026 | RMIT

- GSS502 Global Security, Strategy and Leadership Tutor-Marked Assignment – 01, 2026 | SUSS

- MGT567 Strategic Human Capital and Talent Management End-of-Course Assessment 2026 | SUSS